En savoir plus sur CreditOnline

CreditOnline - Prix

CreditOnline est disponible en version gratuite. La version payante de CreditOnline est disponible à partir de 900,00 €/mois.

Produits similaires à CreditOnline

Tous les avis sur CreditOnline Appliquer les filtres

Parcourir les avis sur CreditOnline

Tous les avis sur CreditOnline Appliquer les filtres

- Secteur d'activité : Services financiers

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les jours pendant 6 à 12 mois

-

Provenance de l'avis

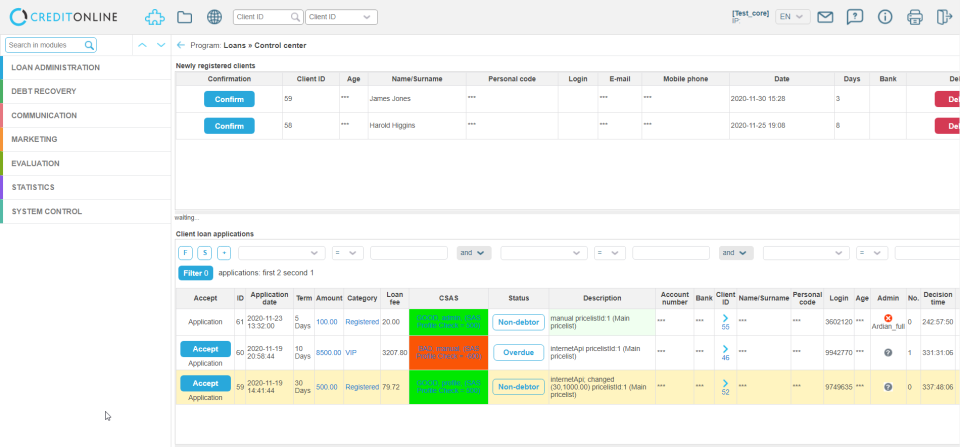

CREDITONLINE

Easy to use. Powerful tool for daily use. Great design and features. Best quality/price choise.

Avantages

This software has a lot of tools that you need to use in loan business. It has great customer support service 24/7. Best quality/price choise.

Inconvénients

Personalized reports must be programmed separately.

- Secteur d'activité : Services financiers

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les jours pendant plus de deux ans

-

Provenance de l'avis

Creditonline - The power of loan business

Overall, I would rate the work with the system as very good. The functions of the system correspond to the requirements for credit management. "Step by step" introduction of new functions or products is not a problem.

Avantages

A very comprehensive product for credit management, in which you can set almost everything that is needed in this line of business. I would highlight the availability and willingness of support. Once the system is implemented, credit management is already very simple. The advantage is certainly the very high level of automation of the entire loan management process and the consequent saving of human resources. The description of the API is very well done. The possibility of quick implementation of legislative changes is also an advantage. The system is in constant development, which brings improvements and new functions.

Inconvénients

One of the disadvantages of the system is certainly the outdated and minimalistic help system. The complexity of the system can also be perceived as a certain disadvantage, mainly due to the need to initially "set everything up".

- Secteur d'activité : Banque

- Taille de l'entreprise : 51–200 employés

- Logiciel utilisé tous les jours pendant plus de deux ans

-

Provenance de l'avis

good system for loan application check

Avantages

we can, by yourself, change the CSAS reject/ accept/manual check rules

Inconvénients

trigger conditions form, request the external database only "IF"we implemented a simple filter for a very long time (almost a year), a very inelastic system in this point

- Secteur d'activité : Services financiers

- Taille de l'entreprise : 11–50 employés

- Logiciel utilisé tous les jours pendant plus de deux ans

-

Provenance de l'avis

Long time user of the system

I have been working with the creditonline system since 2016. Since then, many different projects have been implemented, from very simple to very complex and very time-consuming. The functions of the system have been fully adapted to the needs of company. The system is periodically updated, additional new functions appear, which make everyday work easier. It would be great if the queues of requests were reduced a bit and some requests would be done faster.

Avantages

*The system is simple*It is easy to adapt to a specific business*The system provider always creates additional necessary functions/processes*A significant number of changes can be made without the intervention of a developer.*The system works smoothly, interruptions are very rare.

Inconvénients

For some seemingly very simple tasks, the deadlines seem quite long. Waiting 60 days for a request to be processed sometimes seems really too long.

- Secteur d'activité : Internet

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les jours pendant 6 à 12 mois

-

Provenance de l'avis

CreditOnline’s Clients review

We have been CreditOnline’s Clients since 2011. Since then CreditOnline has grown in size, integration and abilities. Currently I can say that CreditOnline seems to be the quickest in the sector in module integration and software capabilities. The list of integrations seems to have all relevant modules for a business either entering the fintech world or already seasoned in it. With any new modules or integrations being added weekly.

Avantages

Vast list of integrations, system works quickly and efficiently. Bugs or errors are very rare but when there are sorted quickly and effortlessly.

Inconvénients

The list of integrations can be very long and therefore a bit confusing at times to choose from. However, the team is always happy to help and explain the modules including which is best to choose for specific needs.

- Secteur d'activité : Services financiers

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les jours pendant plus d'un an

-

Provenance de l'avis

Very good value for money

Avantages

The software becomes easy to use after about 2-3 months of constant use. It has the best price in the market which is the reason for our choice.

Inconvénients

Takes time to get the desired features added to the main software and can be costly.

- Secteur d'activité : Services financiers

- Taille de l'entreprise : 11–50 employés

- Logiciel utilisé tous les jours pendant 6 à 12 mois

-

Provenance de l'avis

We used Creditonline’s solution to launch our system.

Avantages

The product is oriented for the profitable loan business portfolio scaling. Creditonline’s main attribute was integrity – it allowed our company to go into the market quickly and the solution offered by them was appropriate. What is especially useful is that we only pay for what is needed in our particular case and therefore we did not acquire additional unnecessary expenses.

The solution allowed our businesses to grow by adapting it's processes to our requirements. It also reduced staff costs and unnecessary human error and improved bottom line. Creditonline’s team has been great to work with.

Inconvénients

This software impproved a lot the management of our loans portfolio, I guess the only downside, if we can call it a downside, is the learning curve of our agents.

- Secteur d'activité : Services financiers

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les jours pendant plus de deux ans

-

Provenance de l'avis

Creditonline software

Benefits- user friendy, reliable software

Avantages

Functionality and easy to use, good value for money

Inconvénients

Aditional programming , sometimes tikes time to explain problem,

- Secteur d'activité : Services financiers

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les jours pendant 6 à 12 mois

-

Provenance de l'avis

Creditonline review

Best price/quality match, good software for everyday use.

Avantages

Best price/quality match, the software has many features that financial company need.

Inconvénients

Report module is very weak, you can not construct reports that you need manually and need to program them. Also report can not be downloaded in excel format, which you really need when you work with numbers.

-

Provenance de l'avis

Great company

We have been using services of UAB "EGROUP EU" for 5 years now. We have been improving together during the whole period and have implemented projects in the Czech Republic, Latvia and Lithuania. The company is represented by qualified employees who are open to suggestions of the clients. Every time any questions arise, a solution is presented. High-level programmers create unbelievable electronic business platforms.

An appropriate pricing system and business module encourages us, the client, to look for new markets. We entered this business as novice entrepreneurs, made a lot of mistakes and learned from them until we could accurately assess the demand of the market.

In our business it is most difficult to compete with the veterans, therefore we have to overcome them by offering quality services and it is no secret that in order to offer such services investments are needed as well as a great team and appropriate technical solutions. All of the above is offered by EGROUP EU.

-

Provenance de l'avis

6 years with creditonline

We have been using the CREDITONLINE software since the beginning of 2008, i.e. the beginning of UAB EGROUP EU. The start of the first steps taken was by using a rather primitive software which needed a lot of manual work. While the loan business and the needs of clients were expanding so did CREDITONLINE which did not stray from innovations. As of this day we are very happy to use an incredibly broad and intuitive software which features a lot modules and requires a minimal amount of manual work. Due to CREDITONLINE we can expand the business with a minimal amount of employees and its expansions does not require additional human resources.

We are thankful to the employees of UAB EGROUP EU for the constant development of the software, the creation of new modules and rapid responses to any needs and suggestions.