En savoir plus sur Rundit

Rundit - Prix

Rundit est disponible en version gratuite et propose un essai gratuit. La version payante de Rundit est disponible à partir de 299,00 €/mois.

Produits similaires à Rundit

Tous les avis sur Rundit Appliquer les filtres

Parcourir les avis sur Rundit

Tous les avis sur Rundit Appliquer les filtres

- Secteur d'activité : Capital risque et capital-investissement

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les mois pendant plus d'un an

-

Provenance de l'avis

Afficher plus d'informations

Launch Africa Rundit Review

Rundit has been a critical tool in the portfolio management function of our fund. The team is incredibly responsive to queries and suggestions and have rolled out functions that we specifically requested. We are keen to see how the tool develops and how it will enable us to be better investors.

Avantages

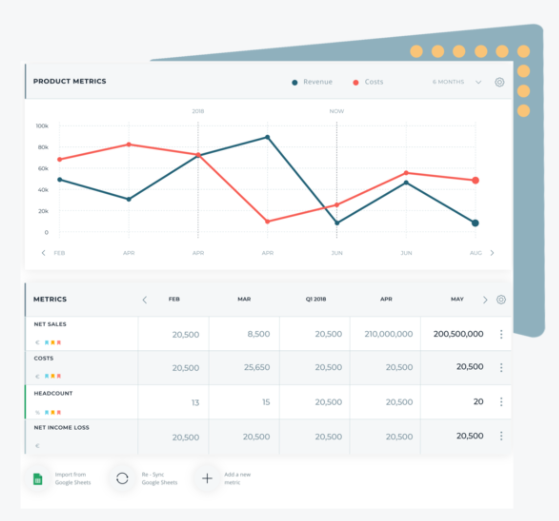

The ease of use and its integration with Google sheets that makes from a seamless experience gathering portfolio company data

Inconvénients

The limitations it has on customising LP report one pagers.

Alternatives envisagées

CartaPourquoi passer à Rundit

The value proposition and pricing worked better for our funds needs- Secteur d'activité : Capital risque et capital-investissement

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les mois pendant 1 à 5 mois

-

Provenance de l'avis

Afficher plus d'informations

Petra's Review

super responsive, we're happy with our choice

Avantages

Clear interface, easy UX and the client service is great

Inconvénients

Sometimes numbers disappear that have been put in manually but appear when I've refreshed the page, or there is a bit of a lag when logging on, switching between pages

Alternatives envisagées

CapdeskPourquoi passer à Rundit

had the currencies we needed and more cost effective- Secteur d'activité : Gestion des investissements

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé toutes les semaines pendant 6 à 12 mois

-

Provenance de l'avis

Afficher plus d'informations

Very good product. Quick and easy to deploy.

Good, easy product to use. Very good customer service. Reasonable pace of feature development and Rundit seems to have a product pipeline that is in tune with our needs

Avantages

The software is easy to deploy and use. Right now we are mostly using the portfolio and investment management features. We will be using the exported reports, once Rundit is fully deployed across all our portfolio companies.

Inconvénients

The biggest challenge is to get the portfolio companies to provide the correct information on time. We are managing all portfolio entries and hope to push this to the companies in due course.

- Secteur d'activité : Gestion des investissements

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les jours pendant 1 à 5 mois

-

Provenance de l'avis

Afficher plus d'informations

Irene Prota review - Ilavska Vuillermoz Capital

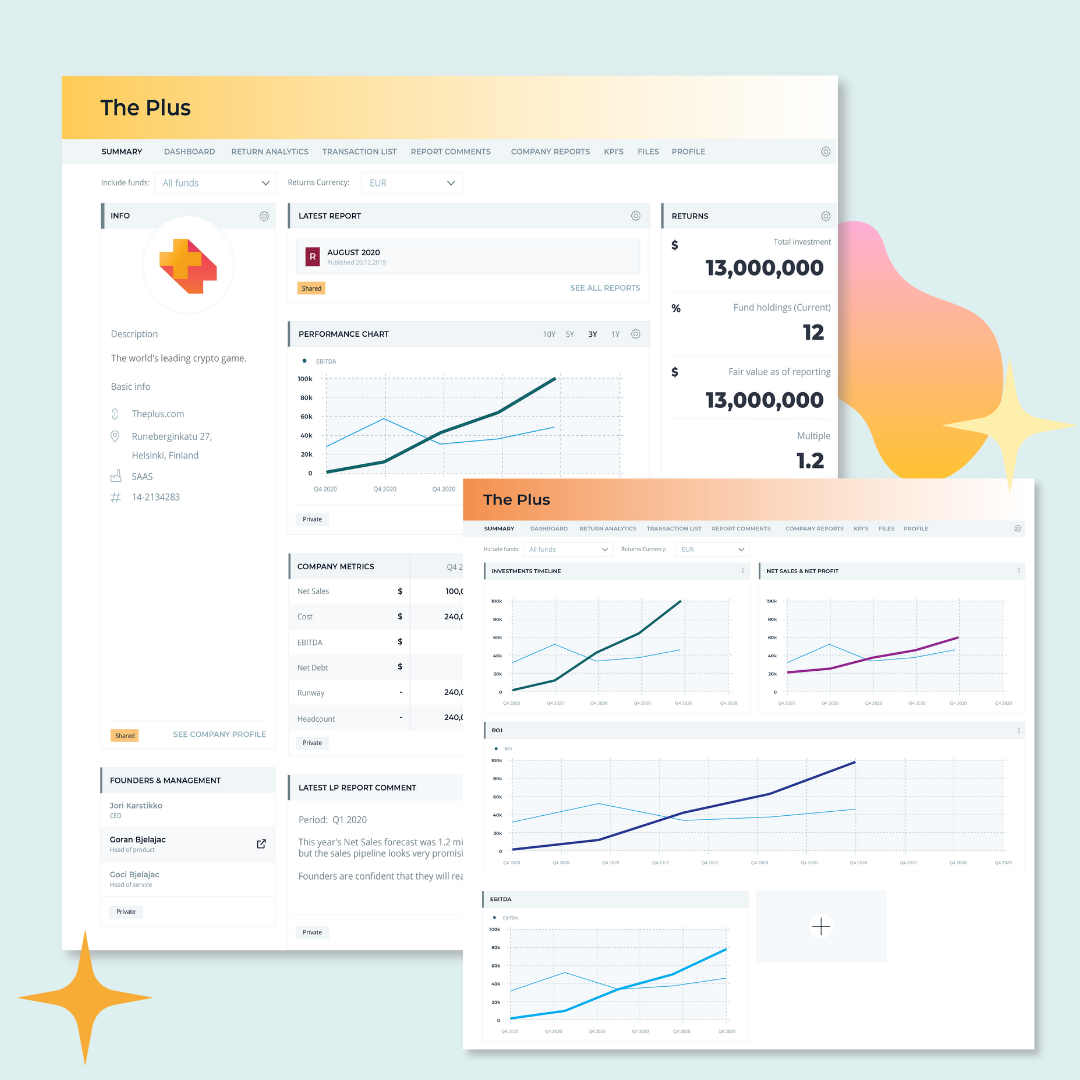

I am solving many problems above all with the quarterly reports we need to send to our investors. It's also very useful to have all the data in one place so that I can quickly look at them when I need them.

Avantages

The most important feature in my opinion is the KPIs table, it's what I use most of the time on Rundit, I like it. The product is highly user-friendly, for this reason i've suggested to to many of my peers and some of them also subscribed to it.

The integration with our business processes has been very easy.

Inconvénients

What to improve in the KPIs table: I do not see the graph in the Metrics above the KPI Metrics even though I've added the metrics in the table; the import directly from excel would be very appreciated.

Moreover, I'd like to add another Fair Value (i.e. Fair value as of 31.12.2021 and 31.03.2022) but it doesn't seem possible.

Réponse de Rundit

Thank you for your review, it is greatly appreciated!

In terms of the KPI table - the graph above the table reflects the KPIs in case the corresponding time period has been selected for the graph.

Excel import is currently being built by our tech team and will be launched soon!

Regarding showing Fair Value progress over time - you can either use investment overview dashboards to display Fair Value at different time points at a fund level. At a company level, you can use the dashboards tab to create a chart for Fair Value progress over time.

Please feel free to contact our support so we can assist you further!

- Secteur d'activité : Capital risque et capital-investissement

- Taille de l'entreprise : 11–50 employés

- Logiciel utilisé tous les jours pendant 1 à 5 mois

-

Provenance de l'avis

Afficher plus d'informations

Simple and functional at the same time

Overall experience with Rundit is wonderful - the solution is very elegant, simple, affordable for even a small VC fund.

Avantages

We liked that Rundit is very easy to onboard and use, the interface is extremely user friendly, the team doesn't require any special sessions or training to start using it.

Inconvénients

The transaction data might be improved as it's hard to find what was the valuation of the company in particular rounds, the number of shares we hold, and how much was invested.

- Secteur d'activité : Capital risque et capital-investissement

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé toutes les semaines pendant plus d'un an

-

Provenance de l'avis

Afficher plus d'informations

Best way to track portfolio metrics

The support team is amazing and the product team takes the time to understand client needs and how they can improve the product.

Avantages

Very intuitive platform and new features are very well adjusted to client needs. Easy to track metrics - which is my main use.

Inconvénients

It is still hard to get companies to use this platform.

- Secteur d'activité : Capital risque et capital-investissement

- Taille de l'entreprise : 11–50 employés

- Logiciel utilisé toutes les semaines pendant 1 à 5 mois

-

Provenance de l'avis

Afficher plus d'informations

Good quality, looking forward to the new functions

Knowing which companies made reports, which didn't. Looking at basic metrics of all companies at the same time. Optimization of preparing reports for the LPs.

Avantages

Easy to use, without unimportant functions, good notifications, simple UX.

Inconvénients

Low level of dashboard customization, lack of possibility to co-manage portfolio companies profiles.

- Secteur d'activité : Capital risque et capital-investissement

- Taille de l'entreprise : 11–50 employés

- Logiciel utilisé toutes les semaines pendant 6 à 12 mois

-

Provenance de l'avis

Afficher plus d'informations

Great UI, offers what we need

Very good. Great customer support, meets all our company's needs.

Avantages

Being able to have our portfolio companies reporting under one platform.

Inconvénients

UX could be improved a bit. And fund managers could have more control over what companies must write, clearly showing unnecessary metrics and sections to end users.

- Secteur d'activité : Capital risque et capital-investissement

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé toutes les semaines pendant 6 à 12 mois

-

Provenance de l'avis

Afficher plus d'informations

VC Portfolio and Fund Management with Rundit

Avantages

- excellent dashboards

- easy fund management and reports export

- very good customer support and parameterization

- very easy integration

Inconvénients

- new KPIs on the portfolio companies need to be easily adaptable

- Secteur d'activité : Capital risque et capital-investissement

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les mois pendant plus d'un an

-

Provenance de l'avis

Afficher plus d'informations

Can See the potential

Avantages

That we can follow the investments and the companies can fil in KPI´s and figurs for us to follow.

Inconvénients

Since we havn´t had enough time to put into Rundit I don´t have anything to say regarding least.

- Secteur d'activité : Capital risque et capital-investissement

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les mois pendant 6 à 12 mois

-

Provenance de l'avis

Afficher plus d'informations

Good but clear they're still developing it

Avantages

Easy to see the full portfolio in one platform, assuming everyone uploads their data

Inconvénients

It's hard to incentivise portfolio companies to use it. Would be good to improve the reporting functionality and incentives for them to use it. If they don't then the portfolio reporting is ultimately redundant.

- Secteur d'activité : Capital risque et capital-investissement

- Taille de l'entreprise : 2–10 employés

- Logiciel utilisé tous les mois pendant 1 à 5 mois

-

Provenance de l'avis

Afficher plus d'informations

A big step-up from Excel but still missing some features

It is okey, way better than Excel and seems to have great potential.

Avantages

A big step to stop being dependent on a large excel-sheet that can easily by altered with by accident. Gives better reliability of the numbers of the portfolio companies.

Inconvénients

I mainly miss two features:

1. The ability to see "logs" of what each user has updated/changed and when

2. A "time machine" functionality to pick a specific date you want to see all information as at that date.

- Secteur d'activité : Gestion des investissements

- Taille de l'entreprise : 11–50 employés

- Logiciel utilisé tous les mois pendant 6 à 12 mois

-

Provenance de l'avis

Afficher plus d'informations

good interface experience, but lack of api

Avantages

it is easy for the startups to make report, and for the investment team to review the reports in a structured manner

Inconvénients

There is no API that allows us to pull the report easily and make the analysis of it